I recently needed a Canadian bank account to complete a Government bureaucratic procedure. As a Canadian I thought it would be a pretty trivial process, despite being a nonresident. Little did I know how wrong I would be…

(and no, we won’t be discussing tax/compliance issues here, either!)

The Canadian “Big 5” banks

In Canada, the “big 5” are the biggest and probably the most popular banks. I’ll also include National Bank of Canada in here for posterity’s sake. I started at these banks, figuring they would be the easiest to open an account at.

BMO

To their credit, BMO has a slick website and online application that makes their fees and features clear. No need to use a comparison matrix loaded with checkmarks to understand their accounts.

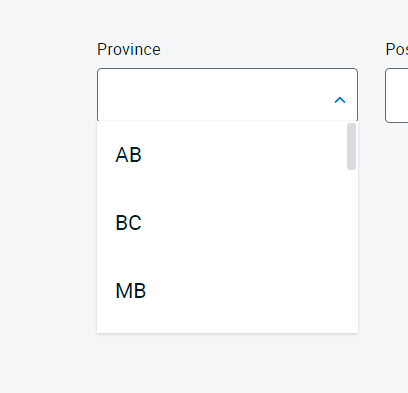

I don’t know if this is intentional, but if you click “next” quickly enough on the online application, it’s possible to skip all of the name/contact/etc. pages to reach the address input page immediately. Once I arrived there, I found what would be a recurring pattern at most other banks:

There’s no way to input a non-Canadian address! So, BMO is a no-go.

RBC

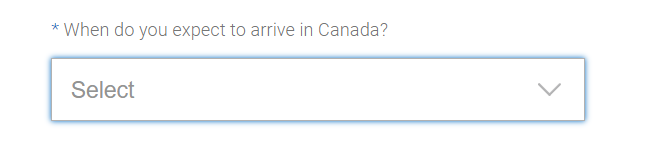

RBC is more explicit than BMO and simply asks if you’re a Canadian resident. When you answer no, it proceeds to a “nonresident” application. Unfortunately, it seems like the nonresident application is for people who plan to move to Canada at some point (particularly as there’s a required question “When do you expect to arrive in Canada?”). RBC is also a no-go.

Scotiabank

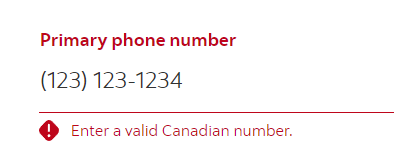

Scotiabank is a little bit sneakier than BMO and RBC. To start the application, it requires a Canadian phone number:

I’m not sure how the application would work if one entered a valid, but this requirement means that Scotiabank is also a no-go.

CIBC

CIBC has the same problem as BMO. Enough said, it’s a no-go.

National Bank of Canada

…and NBC also has the same problem as CIBC and BMO. Another no-go.

TD Bank

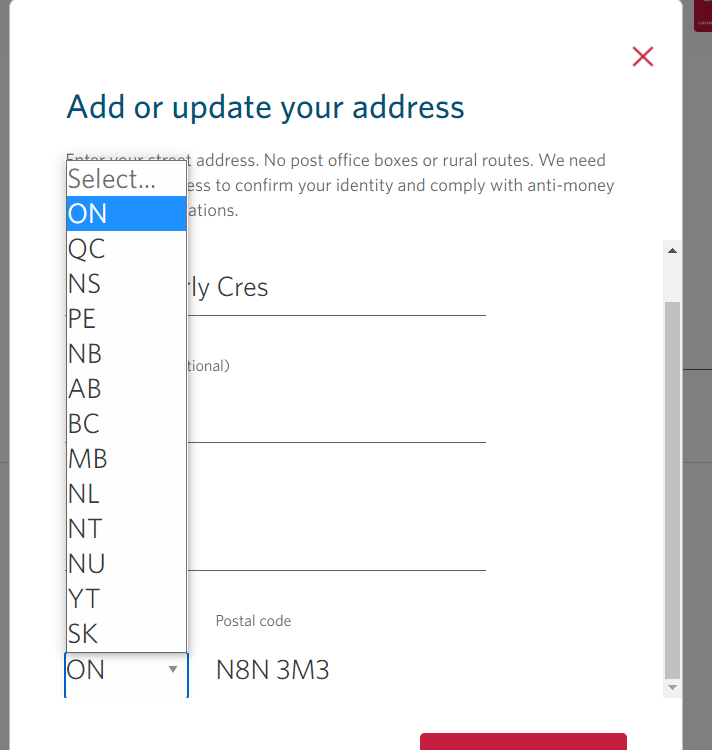

TD Bank is the first of the Big 5 that seems to be somewhat open to non-residents. In fact, their online application even allows you to input a non-Canadian address each time an address is required! This is pretty cool and I assume it would allow one to open an account online.

It’s unfortunate that they don’t have the best fee structure for their accounts though, although the monthly fee on their lowest tier chequing account can be waived with a balance as low as CA$100.

Caveat

Some people online say that calling an advisor at a Big 5 bank will lead to better results for non-residents than trying to use their respective online applications. Such non-resident accounts might be subject to higher fees and/or higher minimum balances, which is normal. I haven’t tried or been able to verify this, though.

Other alternatives

Online Canadian banks (Tangerine, Simplii…)

Much like the US, online banks like Tangerine, Simplii, and EQ have gained significant traction in Canada based on the promise of lower fees and higher interest rates in exchange for fewer account options, no/few physical branches, and reduced interactions with humans. Unfortunately, this “pro-automation” feature means that none of the online banks I tried offer non-resident accounts (in fact, many explicitly state that they forbid non-residents on their FAQ or support pages), and it’s more difficult to reach a human with these banks than with a traditional banks. Perhaps worth further exploration in the future.

“International accounts”

Some banks, notably HSBC, offer “international accounts” that are actually an agglomeration of many bank accounts in different countries, typically using various national subsidiaries of the parent bank.

The catch is that these “international accounts” often require a personal relationship with a banker and/or a large amount of capital to open. (HSBC, for example, requires a $75,000 balance or a $50/month maintenance fee. Wow!) I would assume this is probably the easiest option for people who can meet the requirements, however.

TransferWise

TransferWise offers a pretty interesting service – they’re not actually a bank but rather an “e-money institution” or “financial technology company”, much like shops such as Revolut and Current. Their claim to fame is that they offer very good exchange rates and a convenient cross-border banking experience.

With a $20/20€ deposit and ID verification, TransferWise allows one to create “virtual” bank accounts in various currencies, including Canadian dollars. These virtual bank accounts generate institution/transit/account numbers (for CAD)/SEPA and IBAN numbers (for EUR)/account and routing numbers (for USD), so it’s easy to do wire/ACH/SEPA transfers to a TransferWise account.

Although TransferWise does seem to nickel-and-dime on some fees ($9 to get a debit card & $1 + wire transfer fees to transfer money out of the service??), their exchange rates are indeed much better than what banks offer non-relationship customers and the service is very convenient for nonresident customers. It’s a winner in my book.